In the dynamic landscape of 2023, entrepreneurs face the ever-present challenge of managing their finances effectively to ensure business sustainability and growth. Financial management is not just about keeping the books in order; it’s about making strategic decisions that can propel a business forward.

This year, understanding cash flow has become crucial for entrepreneurs. It’s the lifeblood of any business, dictating its ability to invest, expand, and even survive. Smart financial management involves meticulous planning and monitoring of cash flow to avoid common pitfalls like overexpansion or running out of operational funds.

Moreover, in 2023, the role of technology in financial management has been underscored. Entrepreneurs are leveraging financial software and tools for real-time analytics, budgeting, and forecasting. This tech-savvy approach provides a clear view of financial health, enabling data-driven decisions.

Another key aspect is diversifying revenue streams. With market conditions more unpredictable than ever, entrepreneurs are finding innovative ways to diversify, reducing dependence on a single source of income and spreading risk.

Lastly, financial literacy is essential. Entrepreneurs must understand financial statements, tax obligations, and regulatory requirements. Knowledge in these areas not only prevents costly mistakes but also reveals opportunities for tax savings and efficiency improvements.

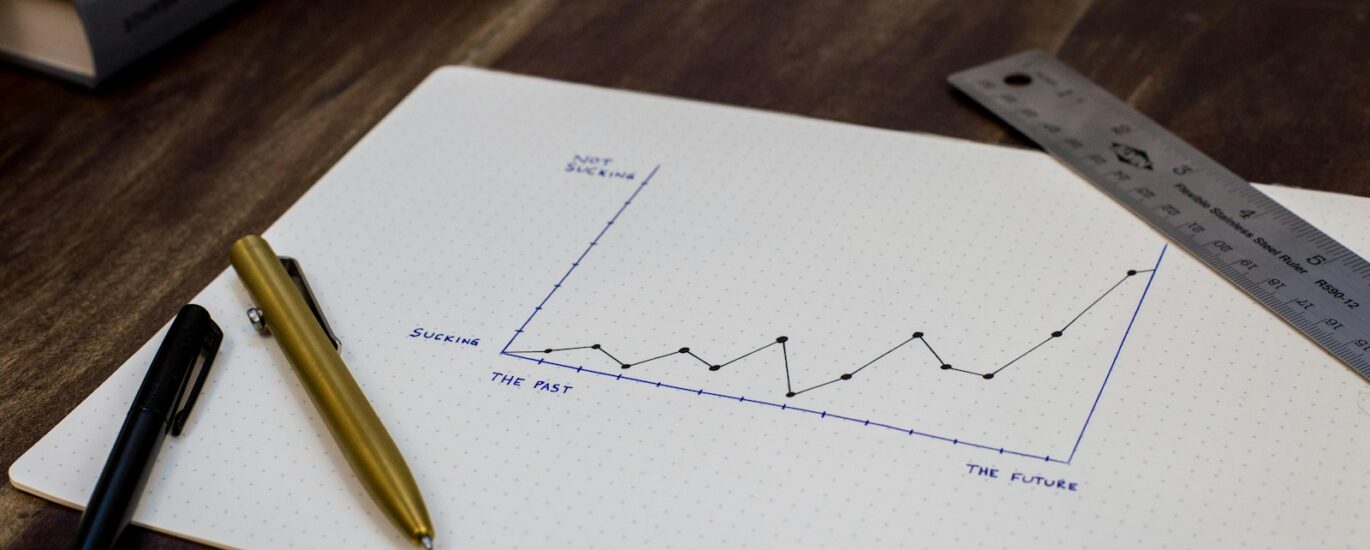

In 2023, financial management for entrepreneurs is about more than survival; it’s about strategic growth. With careful planning, technological integration, and an emphasis on financial education, entrepreneurs can navigate their businesses through the complexities of the modern marketplace toward long-term success.